- Invest in Łomża

Contact

Address: Stary Rynek 14Phone: +4886 215 67 00Email: ratusz@um.lomza.pl

- About us

- Why Łomża

- Location offers

- Investor's zone

Subzone of the Łomża Suwałki Special Economic Zone

Entrepreneurs placing their investments in the Łomża Subzone of the Suwałki Special Economic Zone may benefit from public aid granted in the form of income tax exemptions constituting regional aid. Exemption from income tax from legal and natural persons is granted in subsequent years, until the available public aid pool, i.e. the maximum value of benefits in the form of regional aid that can be obtained by an entrepreneur in connection with a given investment project, is exhausted. The amount of public aid is the highest in the country and amounts to 70% for small entrepreneurs. The condition for starting operations in the zone is to incur capital expenditure in the amount of min. EUR 100,000 and the creation of new jobs

.

Benefits of investing in the Łomża Subzone of the Suwałki Special Economic Zone:

•income tax exemption up to a maximum of 70% of investment outlays or costs of new jobs

•real estate tax exemption for new investments or jobs for up to 6 years

•attractive and developed land with technical infrastructure at competitive prices

•excellent location at a distance of 140 km both from the capital of the country and the northern and eastern borders of Poland and the eastern border of the European Union

•full legal and organizational support from the City Hall in Łomża (Entrepreneur Service Center)

Other incentives for investors in Łomża:

•real estate tax exemption for up to 6 years offered by the City of Łomża

•government programs for new investments and new jobs

•the highest amount of public aid in the country up to 70%

•the possibility of using the European Union programs for 2014-2020

•support offered by the Poviat Labor Office in Łomża

The following SEZs have invested in the Łomża Subzone:

Subzone of the Łomża Suwałki Special Economic Zone:

The plot is available in the Lomza Subzone of the Suwałki Special Economic Zone

Discounts for operating in the zone

Conditions for conducting business in the Zone

Permission to operate in the Zone

POLISH INVESTMENT AREA

Act on supporting new investments of May 10, 2018 (Journal of Laws of 2018, item 1162) and the Regulation of the Council of Ministers on public aid granted to certain entrepreneurs for the implementation of new investments of August 28, 2018 (Journal of Laws of 2018, item 1713) introduced new conditions for investing also in Łomża.

Under the Polish Investment Zone, pursuant to the above provisions, an entrepreneur can obtain support for the implementation of new investments on his own land.

Support is provided to the entrepreneur implementing the new investment, by way of a decision on support.

The decision on support is issued for 15 years.

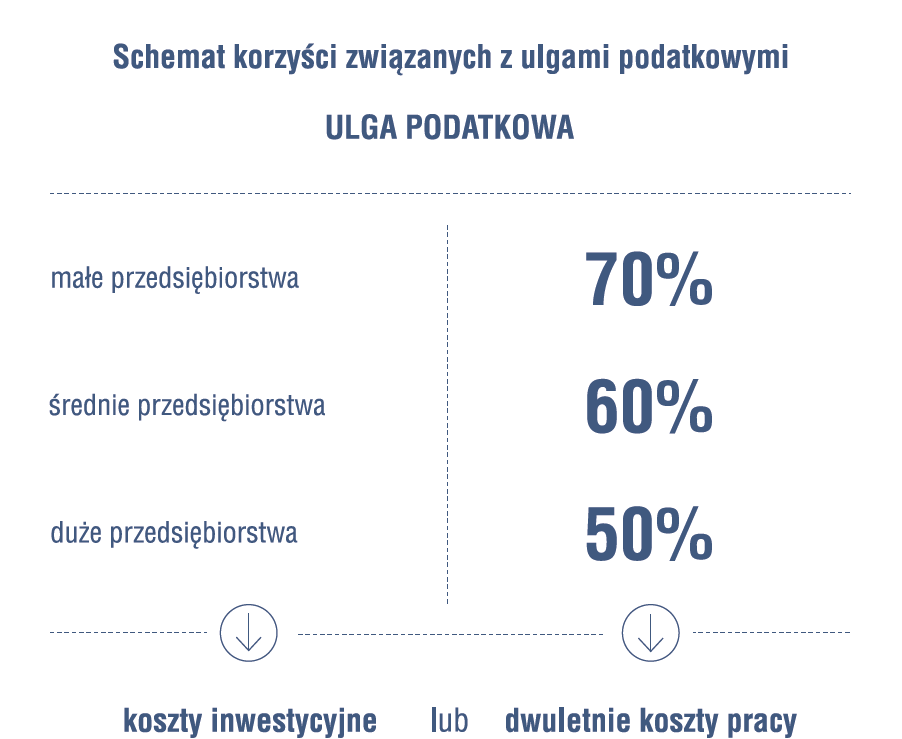

During this period, the entrepreneur may obtain an income tax exemption up to 70% of investment outlays or two-year labor costs (small entrepreneur, medium and large 60% and 50% respectively)

The decision on support is issued for the implementation of a new investment that meets the criteria:

1) quantitative,

2) qualitative;

According to the regulation:

Quantitative criteria are considered met in Łomża if the investment outlays incurred amount to not less than:

- PLN 10 million - a large entrepreneur

- PLN 2 million - medium enterprise

- 500,000 PLN - small entrepreneur

- 200 thousand PLN - micro entrepreneur

Qualitative criteria are considered met if the entrepreneur obtains 4 out of 10 points listed in Table 1 or 2 (services or industry)regulation

Applications for support decisions can now be submitted.

We invite you to contact the Entrepreneur Service Center of the Municipal Office in Łomża, Stary Rynek 14, pokój 124, melectronically cop@um.lomza.pl or by phone 86 2156852.